Is Your Debt Ruining Your Life? Here Is What You Can Do

Debt can become overwhelming to the point that it can begin crushing your life. You could begin to develop the impression that you are drowning in debt and wonder whether there is a way out of the problem you are dealing with. Fortunately, there is a way out of debt which is easily available to you if you are prepared to challenge the problem head-on.

The path to financial freedom is challenging and is definitely not easy. It will take plenty of discipline on your part to pay down debt, curtail your expenditure and most importantly begin learning to save. You will not have the option of trying these factors one at a time because it will take a concerted effort from you to stop your debt ruining your life. What can you do to stop debt ruining your life?

Evaluate your finances

The most important thing you should be doing is getting a clear understanding of your finances. How much debt are you dealing with presently and what is your debt to income ratio?

The most important thing you should be doing is getting a clear understanding of your finances. How much debt are you dealing with presently and what is your debt to income ratio?

Getting an understanding of your financial status will help you to determine whether things can be rectified or you need to contact a bankruptcy attorney if matters have gotten out of control.

What’s your affordability

Understanding your money is going is also essential because it is the best way to cut back on expenses. If you need to begin trimming your expenses you should be considering the items that are not adding value to your life. Services like satellite television, and a smartphone or not essential commodities of life and giving them up for some days may make it seem that you are living life without any luxuries but it will make it possible for you to save up to $250 or more a month. You can use this money to pay down your debt.

Create a payoff cycle

Financial experts have recommended that it is always beneficial paying off debts which have the highest interest rates first while some have mentioned that the accounts with the largest balance should be paid before the others. We recommend paying off the accounts with the smallest balances because it will seem as a victory and can motivate you as you begin noticing fewer accounts that need to be paid.

Financial experts have recommended that it is always beneficial paying off debts which have the highest interest rates first while some have mentioned that the accounts with the largest balance should be paid before the others. We recommend paying off the accounts with the smallest balances because it will seem as a victory and can motivate you as you begin noticing fewer accounts that need to be paid.

After you have paid off one small account use the money from that account to clear another small account. Over a period of time, it will become possible for you to pay off all your debt if you decide to use this method. Keep a close watch on your credit card statements because you will be able to see the difference in the speed at which it was possible for you to become debt free. If you can make more than the minimum payments every month the speed will increase significantly and leave you in a debt-free situation within a short while.

Begin saving money

People who are caught in a debt situation often stop saving money which is a habit they should never be considering. Saving $25 a month may not seem like a huge amount but will save $600 at the end of the year and the money in the savings account can be used as a backup whenever you come across any emergencies that would normally have been placed on your credit card.

If all methods fail and your debt situation is going out of control causing you to miss mortgage payments by several months you have the option of contacting a bankruptcy attorney. You must, however, remember that bankruptcy laws vary by state and therefore you may be required to pay a certain percentage of your debt back to your creditors. You can use these tips for the assistance you need to get started with your new life to ensure debt ruining your life is a thing of the past.

More in Self-Care

-

`

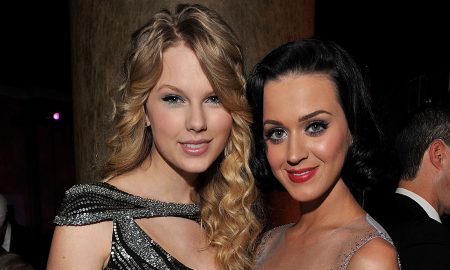

After Feuding for Years, Here’s How Katy Perry ACTUALLY Feels About Frenemy Taylor Swift

`Taylor Swift might be America’s sweetheart with over 2 billion fans (Swifties) worldwide, but the pop singer isn’t a favorite among...

July 30, 2025 -

`

Kim Kardashian Offered a RIDICULOUS Amount to Walk for Balmain After Kylie Canceled for Health Reasons

The Kardashians are undoubtedly one of the most popular clans in Hollywood who can make any event or brand successful just by talking...

July 30, 2025 -

`

This Is Your Fail-Proof Checklist to Survive Your Next Long-haul Flight

Traveling is something we all love, including flying. But most travellers detest those long-haul flights, even the best ones! Having frequently...

July 30, 2025 -

`

Carrie Underwood Loves Counting Calories, But Is It a Healthy Mindset for Staying Fit?

Raise your hand if you have/had a hard time monitoring the food you eat and calculating the calories. You are most...

July 29, 2025 -

`

The Best Size-inclusive Brands that Will Up Your Fashion Quotient

Whether traveling or remaining close to home, a dress that’s both stylish and comfortable, will always remain an asset. Since long,...

July 29, 2025 -

`

Fans Think Kylie and Travis Are Back Together, Here Are All the Clues

So, word on the street is that Kylie Jenner has gotten back together with her rapper ex-boyfriend Travis Scott. While their reconciliation...

July 29, 2025 -

`

Rihanna FINALLY Dropped New Music After 4 Years, But Fans Are Still Disappointed

It’s the musical comeback we’ve all been waiting for. Rihanna recently dropped a bombshell that she’s back to recording music, and the...

July 29, 2025 -

`

The Real Meaning Behind Confusing Code Words Airline Pilots Use

According to statistics, there are about half a million traveling via airplanes at any given time. But only a small portion...

July 29, 2025 -

`

Signs That Your Relationship is Moving Too Fast

Ah, L-O-V-E. Are they the four letters of happiness? Getting into a relationship is always a tricky business, when you are...

July 29, 2025

You must be logged in to post a comment Login